Call us at 830-751-4020

Bookkeeping - Tax - Payroll - HOA Management

Margaret Nixon CPA

Resources For You!

Crane-Quist Ventures is happy to coordinate all of your related services with professionals you already have in place. Should you need any referrals, we are happy to provide you with a list of agencies or companies who are dedicated to you.

Here are trusted partner companies recommended by Crane-Quist Ventures

Tsheets

Lovorn & Ogle, PLLC

Audit and Legal Services

Timekeeping Solutions

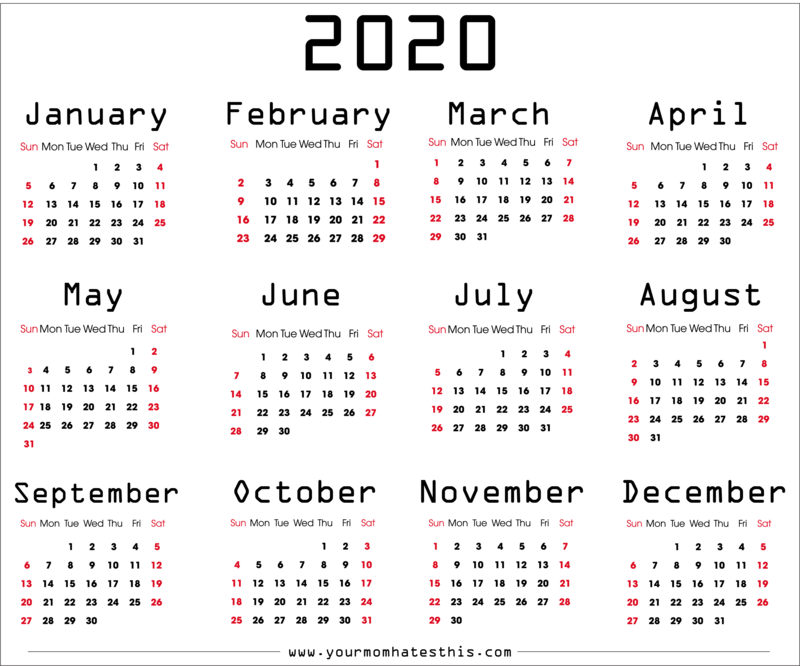

IRS Tax Calendar

Review the tax return deadlines, payment due dates and sign up to synchronize your calendar.

Where's My Refund?

Check the status of your refund here.

Pay My Tax Bill

To securely make a payment on your federal income tax return click here and follow the prompts.

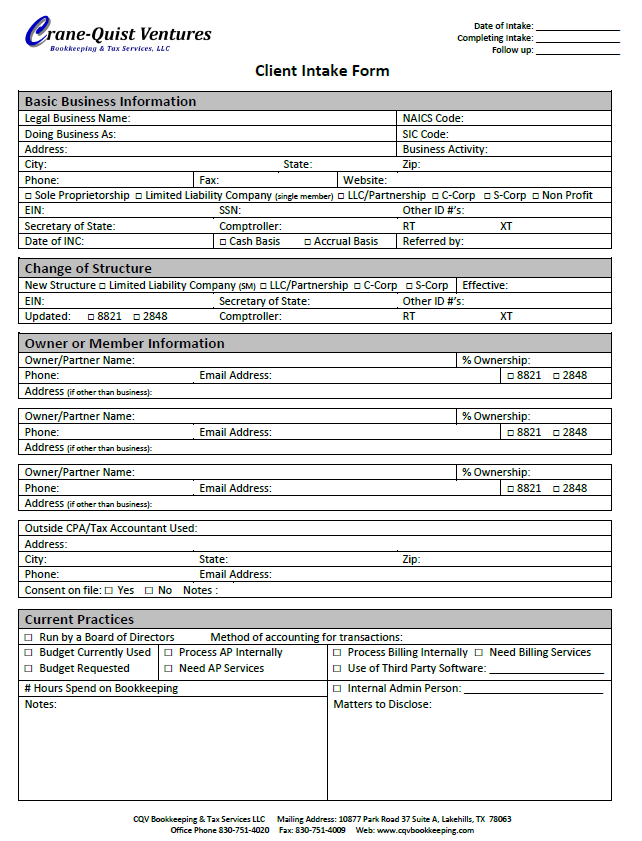

New Client Forms

All tax clients are required to provide a completed income tax organizer and two forms of identification. Bookkeeping and HOA clients are required to complete the client intake form, provide copies of your formation documents and sign an agreement for services. The agreement for services will be provided to you during or after the intake appointment.

Income Tax Organizer

Bookkeeping Client Intake Form

Click on the link above to submit your documents

Starting A Business?

We can assist you with the complete setup. For helpful information with your startup, visit the Small Business Administration's website and check out their business guide section. this is a wealth of information to get you started.

Helpful Links

Cagle Pugh, LTD. LLP